From the Mak Family…

And just like that my son, NTM, is done elementary school!

After a fun and heartfelt ceremony, he’s officially a Grade 8 grad and will be off to the same high school I once attended.

I was particularly impressed by the beautiful venue for the graduation ceremony. Which was made possible by the tireless fund-raising by parents and students.

This year was full of bike rides to school, time with friends and the confidence that comes from being at the top of the heap.

He’s looking forward to restarting as a Grade 9 Freshman with a mix of excitement and a little hesitation.

Rest up during the Summer because the next step of your life is just around the corner!

How is the Spring Market?

The market remained soft in May, with slower activity overall.

The average home sold for $1,120,879, which is up 1.2% from April but down 3.8% compared to May 2024. More importantly, there were only 6,244 sales, a 13.3% drop from last year.

The Bank of Canada is expected to keep interest rates unchanged at the next announcement, putting further rate cuts on hold.

If you are Thinking of Selling…

Keep a close eye on both the re-sale and rental markets to see if selling now makes the most sense.

If you are thinking of buying…

There is more inventory and greater selection, giving buyers more choice and leverage. If you have specific needs, this could be a good window to act. Just be sure your financing is in place. In some cases, selling your current property first might make sense.

Wondering if now is the right time to buy or sell?

Call me at (416) 276-4895 and let’s have a chat!

The Day My Heart Stopped…

“You’ll need to write us a cheque for $400,000… or you can’t buy the house,” the advisor said.

“What???”

My heart stopped. Blood drained from my face. “How is this possible??”

Suddenly, we were on the verge of losing our dream home and I had no idea why.

The Day My Heart Stopped…

“You’ll need to write us a cheque for $400,000… or you can’t buy the house,” the advisor said.

“What???”

My heart stopped. Blood drained from my face. “How is this possible??”

Suddenly, we were on the verge of losing our dream home and I had no idea why.

In Part 1 of our house-buying journey, I shared how we spent years searching for our new home and finally found it.

The sellers accepted our offer, which was conditional on home inspection and financing. Since we were already pre-approved, I thought this was just a routine stop at the bank.

Then the advisor dropped the bomb: we needed an extra $400,000!

A flood of thoughts raced through my mind:

“Why so much more money?”

“When did our finances change?”

“How could this be right?”

I pushed back. “That can’t be right. We’ve paid off over 90% of our home, and buying a home only slightly more expensive!”

But he insisted his calculations were correct.

So, I left the bank in disbelief, unsure what to do next.

Sitting in the car, I immediately called my mortgage agent, Chris, who had originally placed me with this bank. I trusted his judgment.

Mortgage agents compare offers from different lenders, and I hoped he could make sense of the situation.

“Yeah… he’s way off,” Chris said. “Your numbers are totally fine. Let’s go through them together.”

We reviewed everything line-by-line. Everything checked out. What a huge relief!

Looking back, I suspect the advisor specialized in financial investments, not mortgages. Either way, it was a stressful moment that I’ll never forget and a reminder of why preparation matters.

Here are two key lessons:

1. Know Your Numbers

Before you start house-hunting, make sure you understand your finances.

It would be crushing to fall in love with a home, only to find it’s out of reach.

That’s why in my 7-step buying process I start by helping clients understand their true budget and get properly pre-approved through a trusted mortgage agent, so they can move forward with confidence.

2. Include Conditions in Your Offer

Even if your finances seem solid, always include a financing condition in your offer.

If mortgage rules shift or the house doesn’t appraise high enough, you need a way out. Without that condition, you’re stuck with the contract and could face huge financial risk.

Stay tuned for Part 3, where we face our next hurdle in the home buying journey.

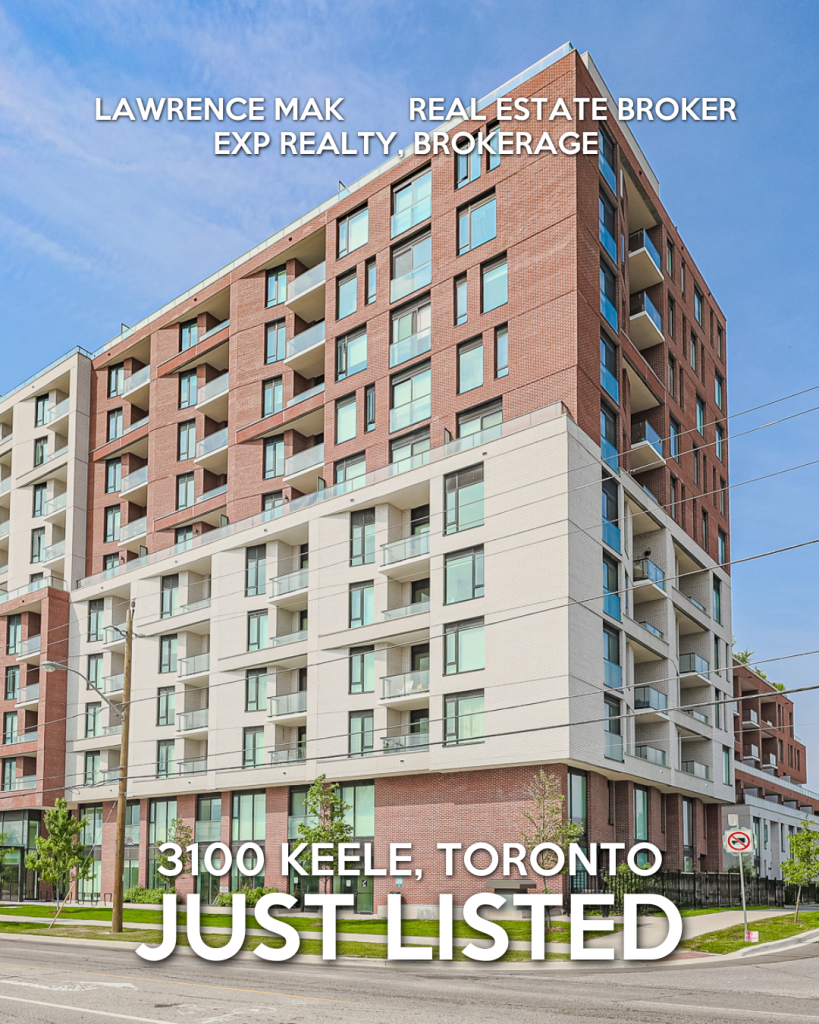

JUST LISTED

3100 Keele Street, #312

2 Bed

2 Bath

1 Parking

A modern building located near Keele and Sheppard Avenue. This bright suite features an open-concept kitchen filled with natural light and sits within a family-friendly community.

For a Private Tour, Call me at (416) 276-4895.

TESTIMONIAL

“Lawrence was great in providing factual information and addressing our worries”

Congrats to M & S for trusting me with finding your home in Willowdale.

After seeing more than 50+ houses and I’m so happy we were able to negotiate an amazing deal on this one!

Looking to move?

Call me at (416) 276-4895 and let’s have a chat.

TESTIMONIAL

“Lawrence went above and beyond to ensure the transaction executed smoothly and efficiently”

Congrats to “M” for finding an amazing tenant. The rental market is a little slow and you still managed to secure a FULL PRICED tenant after a month.

Curious about your investments?

Call me at (416) 276-4895 and let’s have a chat.

Are you looking for the hardest

working agent in the GTA?

LAWRENCE MAK

Real Estate Broker

EXP Realty, Brokerage

(416) 276-4895

Homes@LawrenceMak.com